If you stay in an at-fault state and also another chauffeur causes the crash, then you can avoid paying your insurance deductible. Nonetheless, the process behind that can take some time. Some insurance experts encourage you to pay your insurance deductible by opening up an insurance claim with your insurance coverage business, as well as your insurer can work to get that cash compensated for you.

Car Insurance Deductible FAQs, Having a $1,000 insurance deductible ways that if you're associated with an accident or an incident, you are required to pay the very first $1,000 for repairs before the insurer starts paying your advantages. Yes, many auto insurance deductibles are analyzed on a per-claim basis. This implies that each time you submit a claim, you will certainly be required to pay your deductible.

insurance risks cheaper cheap insurance

insurance risks cheaper cheap insurance

Typically, $1,000 is the highest deductible you'll see from many insurance coverage companies. The expression out of pocket usually refers to health and wellness insurance policy plans where you have a maximum quantity of cash you would certainly have to pay within a year.

If you have a Waiver of Deductible Endorsement added on your policy as well as satisfy the requirements as laid out in the recommendation your firm will waive your insurance deductible if specific demands are satisfied. Your car was legally parked when it was struck by another auto owned by a determined individual.

Your vehicle was struck in the rear by an additional auto relocating in the same direction and possessed by a determined person. The driver of the various other vehicle was founded guilty of any of the adhering to infractions: a. Operating while under the impact of alcohol, cannabis or a narcotic medication. The deductible would certainly not be forgoed if the operator of your protected automobile under this Part was additionally founded guilty of one of the violations.

While the majority of insurance policy companies use the exact same Waiver of Deductible Endorsement, you must check with your provider regarding the particular language of your endorsement. Without the recommendation connected to your car plan, there is no need that the business waive your deductible, no matter of any kind of at-fault or not at-fault searchings for.

This would be as a customer support, however they are not called for to do so.

When requesting cost quotes, it is important that you provide the exact same details per agent or business. The agent will generally ask for the following info: description of your car, its use, your chauffeur's certificate number, the number of vehicle drivers in your house, as well as the coverages as well as limits you want.

You will be asked to address several questions regarding yourself, where you live, your wanted level of insurance coverage, and also your vehicle or home. Addressing these concerns to the ideal of your ability should result in a far better rate quote - perks. Where to Store, Examine online, the newspaper as well as yellow web pages of the telephone directory site for business as well as agents in your location.

Getting My 6 Ways To Reduce Car Insurance After An Accident - Money ... To Work

In particular, ask them what kind of insurance claim solution they have actually gotten from the companies they advise. For Your Security, When you have actually picked the insurance policy coverages you need as well as an insurance agent or company, there are actions you can take to make certain you get your cash's well worth.

It is illegal for unlicensed insurance providers to sell insurance coverage and also, if you purchase from an unlicensed insurance firm, you have no warranty that the insurance coverage you spend for will ever be honored. Read Your Plan Meticulously, You ought to know that a car insurance coverage is a legal contract. It is composed so your legal rights and responsibilities, as well as those of the insurer, are plainly stated.

You should read that policy and also make certain you understand its components. If you have concerns about your insurance plan, call your insurance representative for explanation.

Things You Must Know BEFORE You Submit Your Case Precious The Majority Of Valued Customer, You're probably reading this since you just recently had a cars and truck accident or experienced a few other kind of loss to among your automobiles, your residence or your company. As well as you're wondering Should I send a claim to my insurance provider or not? Will there be any type of unfavorable consequences? Will my price increase? By how much? Can my policy be canceled as well as what happens after that? Those are really vital concerns.

prices low cost credit score insurance company

prices low cost credit score insurance company

The lower line is this If you're worried concerning the prospective effect of submitting your case, contact us and review your situation! We're below to advise and advise you to explain how your insurance coverage truly works.

Some Ideas on 6 Ways To Reduce Car Insurance After An Accident - Money ... You Should Know

Very first Isn't This What My Insurance Is For? Yes insurance is for paying insurance claims. Your insurance firm pays your protected cases.

I don't wish to turn this record into an insurance coverage guidebook, and also you don't want that, either! However this is a common concern I receive from clients, so I want to explain it to you here extremely simply. Insurance policy, and also the rate you spend for it, is based on danger the threat of a loss occurring.

Insurance claims experience is one of the most essential. Data reveal that individuals that have a case are much more likely to have an additional insurance claim. When compared to a person with no past claims, a person with cases on their record represents a greater threat of loss to the insurance company.

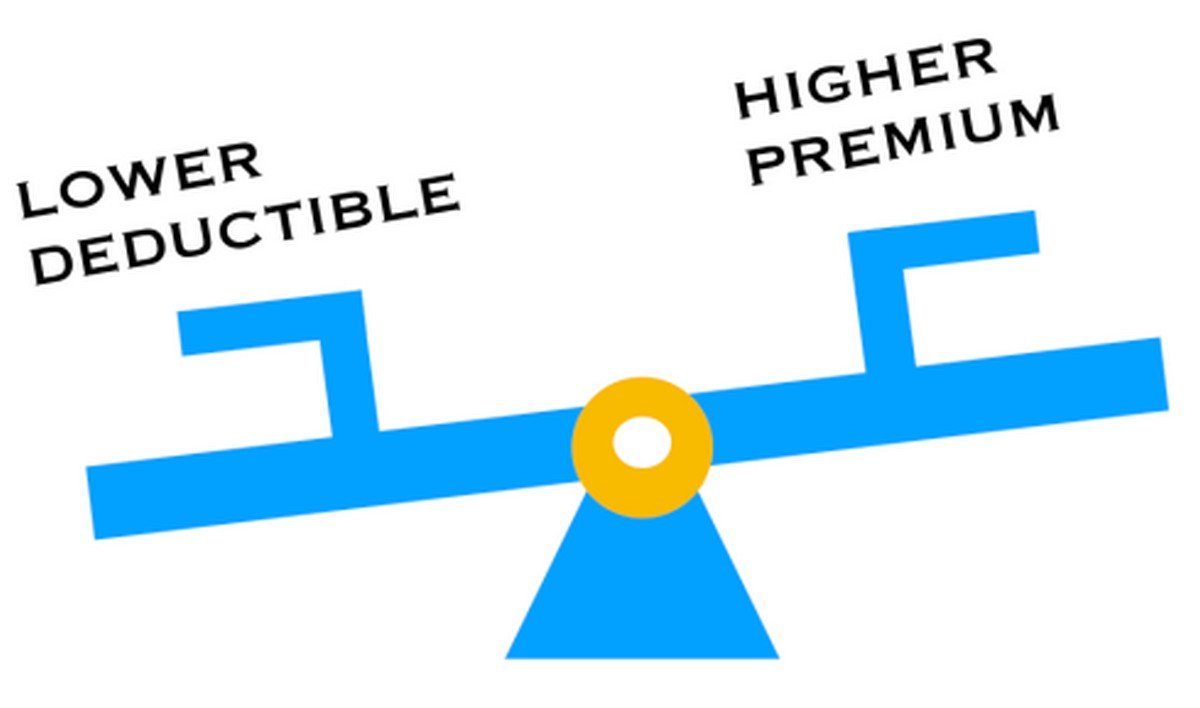

Yephigher rates - cheap. When you have an insurance claim you now stand for higher threat of future loss to your insurance business. And often that rise in threat will be met an increase in cost. This enables the firm to maintain costs lower for people who stand for lower danger. The Dimension of Your Loss If it's not evident, this conversation about whether to send your claim truly just comes into play with small losses losses that come close to your deductible.

That IS what you purchase insurance policy for! On the other hand, tiny losses can occasionally hurt even worse by submitting them. The consequences of sending the claim may outweigh the cash you receive from the company. Sometimes it simply makes good sense to pay your loss on your own and also stay clear of the consequences of submitting a case.

5 Easy Facts About How Do Deductibles Affect Car Insurance Premiums? Explained

You're mosting likely to pay everything anyway, so why report it? For instance, if your insurance deductible is $1,000 as well as your suffer $800 in damages, then your insurance policy firm isn't mosting likely to pay anything (laws). The amount of damage is much less than your deductible. You are in charge of the initial $1,000, so you are accountable for the complete $800 in this situation.

What if the loss is simply a little bit more than your deductible quantity? What if your insurance deductible is $1,000 and also the damage is, claim, $1,200? In this situation, your damages are just $200 more than your deductible.

Did A Person Get Pain? Lots of occurrences include only home damage. When your loss entails property damages only, it sometimes makes sense to take treatment of it yourself as well as avoid the effects that come with sending the claim.

Some companies have a cost for simply regarding everybody. That suggests that no matter exactly how poor your insurance claims record obtains they'll maintain you guaranteed - vehicle insurance. On the various other hand, some companies do not have a price for everybody.

When that occurs you'll be forced to obtain insurance somewhere else, as well as it's most likely you'll pay a significantly higher cost with a brand-new company. State Rules State insurance regulations secure you, the consumer. Among other topics, those laws specify the situations under which a policy can Check out here be terminated or non-renewed. Relying on the kind of insurance coverage, these legislations can supply you a great deal of security or very little.

3 Simple Techniques For What Happens If Someone Hits My Parked Car? - Farmers ...

State regulations, business policies and techniques, the size of your loss, your deductible and also your personal insurance claims history and experience all mix together to develop your unique circumstances. If you're questioning whether or not it makes any sense to submit your case, provide me and also my team a telephone call.

And afterwards make an informed decision.

Crashes take place. When they do, insurance policy is what keeps our finances protected. Whether an auto collision is your mistake or somebody else's, your cars and truck insurance protection need to aid you. Just how much it aids is up to you. This is figured out by the combination of options that comprise your insurance coverage.

Consider deductibles as well as costs as well as driving experience and performance history when selecting an insurer. What Vehicle Insurance Policy Do You Need? Car insurance policy can include a large cost, particularly if you live in certain states. However do not make the mistake of pulling out just to save the extra money because leaving it approximately destiny might cost you extra if you end up in an auto accident or have damages to your vehicle that isn't your fault - vans.

You can pick to get insurance coverage in Virginia or pay the state federal government's division of automobile a $500 cost. However citizens drive at their own danger and are in charge of any damage to their automobile or somebody else's. Obligation protection encompasses liability for both bodily injury as well as property damage.

Things about Is It Ok For A Contractor To Waive My Deductible?

Both can shield you financially from personal suits coming from mishaps. Without Insurance Chauffeurs An Insurance coverage Research Council research study launched in 2021 recommended that as numerous as one in eight at-fault vehicle drivers when traveling are without insurance. This related to roughly 12. 6% of the driving public in the USA.

The lesson below is that you should trust various other drivers as well as don't consider approved that they will have as great protection as you do. It can be difficult to digest that you have to pay a costs and the insurance deductible for someone else's mistake, it's far better than discarding this coverage and also risking losing your lorry.

What happens if your automobile is totaled and also needs to be changed? If the mishap is not your fault, the various other driver's insurance coverage (or your uninsured motorist protection) will certainly spend for the automobile. However there are various other scenarios and all-natural calamities that can additionally damage your automobile. In those instances, you can just rely upon your own insurance coverage.

State legislations, firm guidelines as well as practices, the size of your loss, your deductible and also your individual insurance claims background and also experience all mix with each other to create your special scenarios. automobile. If you're wondering whether it makes any kind of feeling to send your insurance claim, provide me as well as my team a phone call FIRST.

As well as then make an educated choice - cheapest car insurance.

The Only Guide to Understanding Your Auto Insurance Deductible - Bankrate

Mishaps occur. When they do, insurance is what keeps our finances safe and noise - prices. Whether an auto accident is your mistake or somebody else's, your automobile insurance coverage ought to assist you. But just how much it assists is up to you. This is identified by the mix of options that comprise your insurance plan.

What Cars and truck Insurance Policy Do You Need? Automobile insurance coverage can come with a large price tag, particularly if you live in particular states.

You can choose to obtain insurance coverage in Virginia or pay the state federal government's division of motor cars a $500 charge.

Both can protect you economically from personal suits coming from mishaps. Uninsured Drivers An Insurance policy Study Council study released in 2021 suggested that as lots of as one in 8 at-fault chauffeurs when driving are uninsured. This related to about 12. 6% of the driving public in the USA.

The lesson here is that you need to rely on various other drivers as well as don't take for provided that they will have as excellent coverage as you do.

More About Frequently Asked Questions About Auto Insurance Claims

If the crash is not your mistake, the various other driver's insurance policy (or your without insurance driver protection) will certainly pay for the automobile - vehicle. In those situations, you can only rely on your very own insurance.