Variables such as the variety of insurance claims, fraudulence, extreme climate as well as the economy, to call a couple of, all consider. While your driving document could get much better or you've just transformed 25, you can receive a revival with a big boost due to flooding in an additional district or the economic situation refraining so well.

COVID is an example of what can occur when millions of individuals remain at residence and asserts reduce. credit. The insurance provider will begin decreasing your rates on renewal.: Reliant on outdoors elements Do I Receive VIP Discount Rate? While there is no such point called a VIP discount, numerous insurance provider have prices for "Preferred, Elite, or Valued" clients.

Financial savings of 10-20% are not unheard of just for being a liable customer for a lengthy duration of time. The most effective part is: Absolutely nothing needs to be done to certify. The discount simply appears on your renewal.: For Preferred, Elite or Valued customers There are a great deal of variables that can make your insurance rates rise or drop and not every one of them are within your control. cars.

Give us a phone call or start a quote currently: Many thanks for reviewing our short article on reducing vehicle insurance. Still browsing for more info? Have a look at various other insurance products that we provide:.

auto money dui money

auto money dui money

Wondering exactly how a lot the cost of car insurance policy will be for that beautiful brand-new cars and truck you've been fantasizing about? You're not alone. As well as landing on that particular precise number can be challenging for a variety of factors because insurance coverage rates can vary by vehicle kind and also the age of the car.

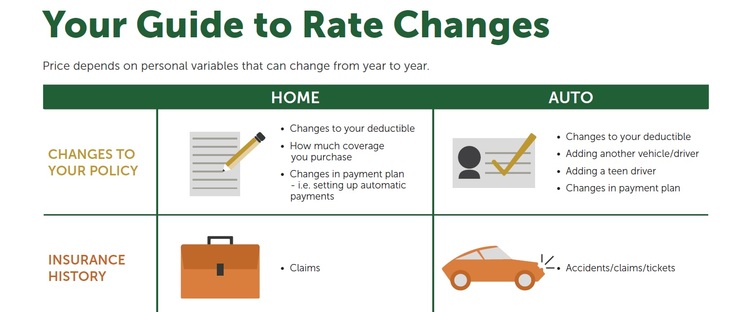

But other factors like your individual monetary history and your family members's driving records can all affect the cost of your premium also. To better recognize what elements are in play, let's take an appearance at what enters into computing the expense of automobile insurance and also dig deep into the factors that sway your insurance prices.

When Will My Car Insurance Go Down? Can Be Fun For Everyone

The majority of car insurer will have their insurance coverage representatives accumulate information regarding your cars and truck when creating a quote. They'll additionally ask you concerning your recommended protection limitations, which can adjust the cost of your cars and truck insurance coverage. cheaper car. Agents will consider state-mandated protection needs to make sure you're obtaining the protection you require to drive lawfully.

Typically, this will certainly indicate you'll be changing your policy, whether you're including your brand-new spouse or removing your ex. You may be able to conserve money on auto insurance policy with a good credit report ranking.

If you've not had a significant crash in five years, this can benefit your automobile costs - car insured. When no property damages or liability insurance claims have actually been made versus you in the recent past, you stand to obtain a far better rate. The expense of your vehicle and also the year it was generated will certainly be used to aid generate your insurance coverage prices.

The area and also postal code where your car is registered will have an effect on the quantity you spend for insurance coverage. Safe areas with low criminal activity prices are generally connected to lower insurance rates. If you have the ability to pack other plans with your vehicle insurance coverage, you can minimize your costs.

With American Household Insurance coverage, you may be able to save huge. You'll likely be asked regarding the means you plan to use your car when you apply for vehicle insurance coverage.

One means you can manage the price of your car insurance policy is to ask for quotes on various coverage limits. By changing these limits and your deductible, you ought to have the ability to locate the protection you require. Due to the fact that numerous states need you to buy vehicle insurance coverage that protects versus uninsured motorists, you're mosting likely to most likely require something near to full protection to accomplish those needs.

Rumored Buzz on Car Insurance Discount - New York Defensive Driving

If your state does not require you to have insurance coverage, including bodily injury liability insurance coverage, you may be doing on your own a huge support if you're ever discovered liable for a mishap that created injuries to others. At American Household, we'll compensate you when you enlist in My Account and choose paperless billing.

There are numerous web sites that can give instantaneous quotes for auto insurance policy from several business along with giving contact numbers for neighborhood representatives. cars. Be wary, nonetheless, of getting car insurance policy directly over the Internet without a local representative. Your automobile insurance coverage rates will reduce as you raise the insurance deductible quantities on your plan.

As an example, if you have a deductible of $100 on your vehicle plan as well as have $1,000 well worth of damage, you pay the first $100 and the insurance firm pays $900. Deductibles are not available on obligation protection - affordable. Many insurer use your credit rating along with accidents, violations, age and also location to establish your costs.

Do not automatically assume that just since you get a price cut the price is an excellent one. Try to pay for your car insurance policy for the full plan period.

Offer a vehicle. Cut down on the number of drivers in the home. Attempt not to buy auto insurance policy as well as health/accident insurance that pay for the same things.

Some organizations, organizations, or staff member teams have insurance coverage strategies available to participants to purchase automobile (or other) insurance coverage through special setups with insurance provider - automobile. In many cases, the insurance coverage business might instantly accept all group participants for insurance policy or only those members satisfying their requirements. Team plans for insurance coverage might conserve you money, however, they may not always do so.

The Best Strategy To Use For When Do Car Insurance Rates Go Down? - Allstate

insurance company laws credit score automobile

insurance company laws credit score automobile

Automobile insurance coverage costs can be mystical at the most effective of times. If you move, acquire a new car or simply get older, prices can increase or down without a great deal of explanation. See what you could save on cars and truck insurance policy, Conveniently contrast individualized rates to see just how much changing cars and truck insurance policy can conserve you.

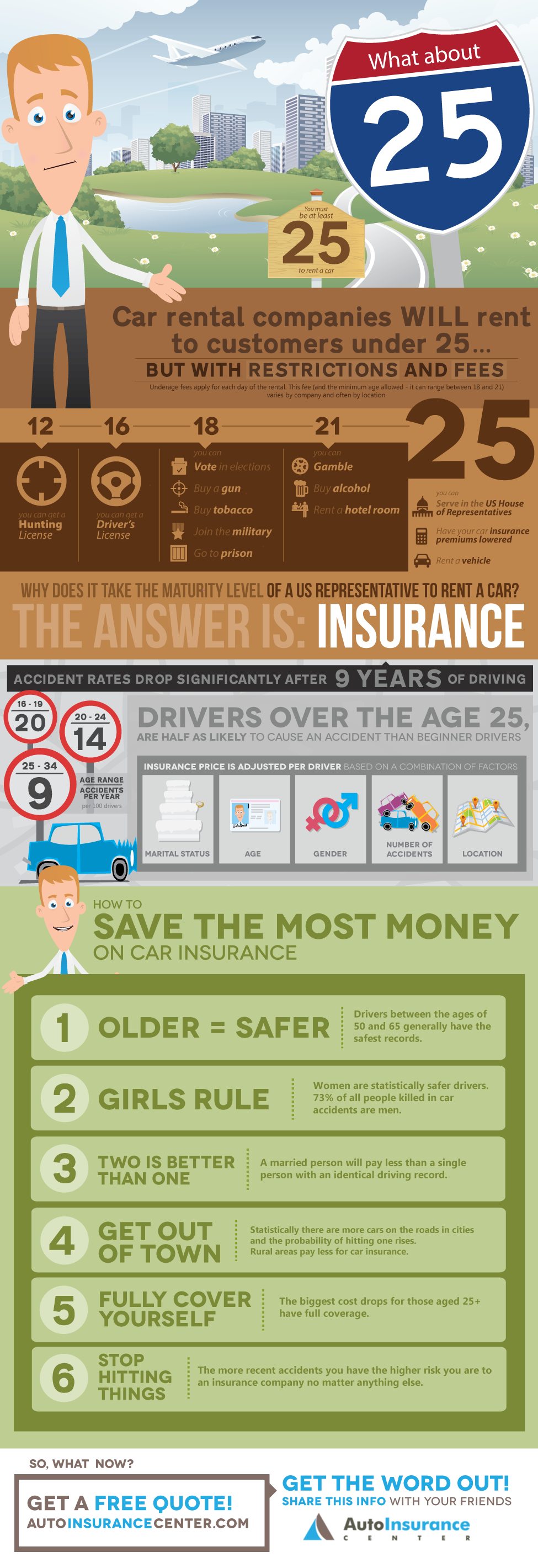

Age as well as gender are two of one of the most common aspects that influence your car insurance coverage rate. As well as while not all states let insurers utilize these factors the same means, the majority of enable them to be Visit this site component of the formula. Vehicle insurance policy prices throughout the country differ based on where you live, however national averages can provide you a concept of what you could pay.

Complete protection policies add additional insurance coverage on top of state minimum requirements. car.

That suggests plans will differ in protection based upon where you live. The rates below show nationwide averages for minimum insurance coverage, so actual prices can differ widely by state. As many new chauffeurs have found, being young is a very easy method to pay even more for auto insurance policy. There go to least two factors for that higher cost.

Second, studies have actually revealed more youthful chauffeurs are far more likely to be in accidents. This results in the high standard car insurance policy prices for young chauffeurs in the graph below - low-cost auto insurance. These rates are for individual insurance coverage policies, which are usually more than rates for family plans with brand-new drivers. However, the accident rate for young drivers assists explain why automobile insurance policy for 20-somethings can put such a dent in your budget.

Still, even if your state does not permit companies to base rates on age, you may pay even more when you're young. Most states do enable insurance companies to make use of driving experience as a consider establishing rates, so vehicle insurance coverage for brand-new vehicle drivers can be costly, no matter of age. If you have actually been driving for just a year or more, you're most likely to pay more than a person who has actually lagged the wheel for a decade.

At What Age Do Car Insurance Premiums Go Down? Can Be Fun For Everyone

Our analysis located that beginning at age 20, men pay higher average insurance coverage prices. By age 30, women and guys pay practically equivalent prices, however the price void never ever absolutely shuts - insurance affordable. Throughout any age teams, males pay greater than ladies generally. In this instance, there's some data to back up charging young guys more.

low cost affordable money cars

low cost affordable money cars

Younger men are much more prone to fatal accidents, with rates for male chauffeurs ages 16 to 19 nearly two times those for women chauffeurs of the very same age. Fatal crash price per 100 million miles driven, Figures from the IIHS based on analysis of the united state Division of Transport's Fatality Evaluation Reporting System 2017 information - cheap car insurance.

By age 30, this difference decreases to simply 2%. Again, this information is based on a national average of the 5 largest auto insurers, so car insurance coverage rates in your state might be much lower. It's one of the reasons we constantly recommend searching to contrast cars and truck insurance coverage prices - cheaper cars.

insure risks cheaper cars credit score

insure risks cheaper cars credit score

Some care much more concerning your driving history, while some care extra about the automobile you drive. auto insurance. Car insurance firms are also limited by guidelines for setting auto insurance prices that vary in each state. States right alongside each other can have large swings in typical expenses as a result of local regulations.

Cross the line right into Georgia, and also that exact same motorist obtains an average price decrease of over $1,000, to $1,698. Consequently, where you live is one of the biggest factors in the rate you eventually pay. To get a concept of what to anticipate, take a look at ordinary car insurance policy prices in your state - vehicle insurance.

Sex is exactly how you determine within culture, while sex refers to certain organic characteristics. Some insurance firms do not acknowledge this distinction and use the terms reciprocally. This implies when obtaining vehicle insurance coverage, they might request your gender, when they actually indicate sex. They might additionally ask for identification that doesn't show your sex precisely.

Why Did My Car Insurance Go Up - The Facts

Various other things that may be thought about consist of for how long you have been driving, your driving document, as well as your cases history. insurance company. Why Fees and Quotes May Differ To aid ensure you obtain an exact quote, it's essential to supply total and also precise information. Imprecise or insufficient details can cause the quote total up to differ from the real price for the plan.

If you neglect information in the quoting procedure concerning mishaps you've been in (even minor ones), your plan rate might be higher. If you neglect to provide information concerning your considerable others' driving history, such as speeding tickets, this might lead to a greater rate. Ensuring you have the appropriate details can make the procedure of obtaining a quote easier - risks.

You're sharing the risk with a pool of motorists. Insurance coverage works by transferring the danger from you to us, your insurance business, and also to a big group of various other individuals.

Remember those partial reimbursements auto insurers issued policyholders throughout the pandemic due to the fact that fewer people were driving? It's payback time. Currently, auto insurance prices are soaring, up 11. car insured. 3% this previous June, compared to the exact same month in 2020, according to the Customer Cost Index. With more Americans on the roadways, insurance coverage prices have actually rebounded to where they were prior to the pandemic struck.

"Clients might save approximately 17% if they have property owners, renters, apartment or life insurance policy with State Farm, along with automobile insurance policy," states State Farm spokesman Jordi Ortega. When you request quotes, see to it you are contrasting comparable levels of defense. Insurance providers love careful drivers and want to award them for their actions.